Mortgage Rates update – the bonds have come down, but not enough?

The Canadian mortgage bond rate has shot up in the past month and is now – thankfully – starting to decrease again …… this is great news for mortgage rates.

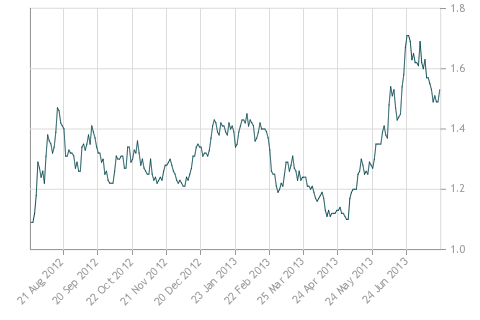

As you can see above, we had a massive climb in the bond yields from 1.15% in the middle of May up to a high of 1.7% in the middle of June. This .55% increase in the bonds was also mirror by an increase in the mortgage rates from 2.89% to 3.49%, an increase of .6%. Since the beginning of July we have seen the bond rates decrease from a high of 1.7% down to the current level of 1.5%, this downward trend has not yet been reflected in the average five year mortgage rate with lenders still offering rates in the 3.39% and 3.49% range.

If the current downward trend continues or even maintains itself, it is very possible that mortgage rates will be decreasing in the near future. My current advice for clients is to contact us to obtain the best current pre-approved rate or approval rate and then allow us to monitor the future rate drops for them. If rates increase before their possession date they will not be affected, if they decrease we will ensure they receive the best rate on the market.

Please always feel free to contact me for your mortgage questions and to look after your purchase or refinance mortgage. Please also feel free to contact me with any questions mortgage rates and your options – Rylan.